Investors can avail the facility online by visiting the bank’s website or net banking facility.

#SWEEP ACCOUNT OFFLINE#

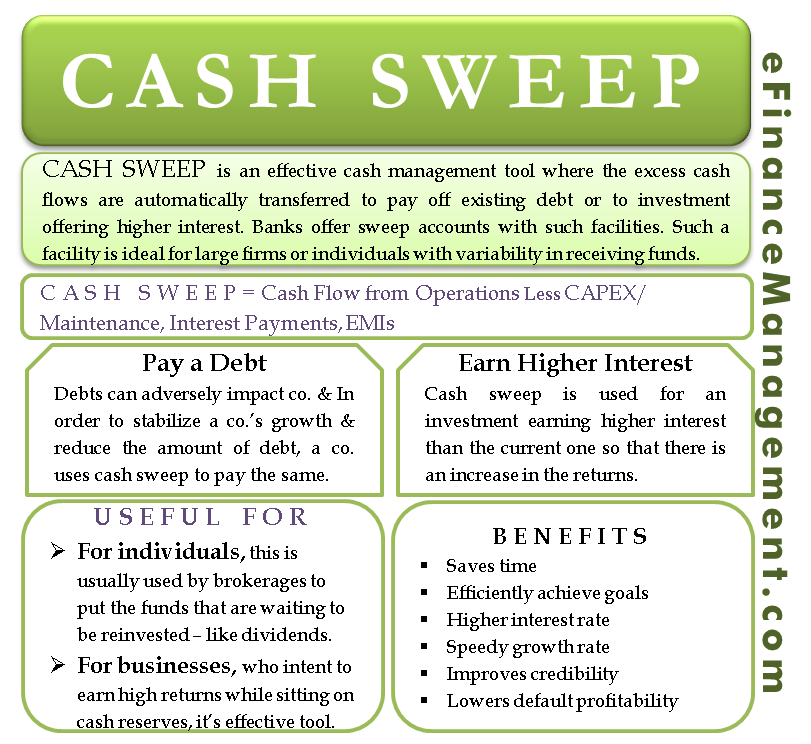

How Can You Avail of the Sweep-In FD Facility?Įligible investors can avail of the sweep-in FD facility through both online and offline modes. Also, the investor can withdraw the excess money invested from the FD account without any extra charges or penalties to meet their short term requirements. The excess INR 15,000 will earn the same interest as the FD. In that case, the bank will transfer the excess INR 15,000 to the sweep-in fixed deposit account. Suppose the investor has received or deposited INR 20,000 in the account, making the total balance INR 45,000. The current balance in the account is INR 25,000. Let’s understand this better with an example if an investor has opted for the sweep-in facility and wants to maintain INR 30,000 in the bank account for expenses. Every time the bank account has excess funds, the bank will automatically transfer them in multiples of INR 1,000 to the FD account. Secondly, they have to set a limit for the balance to be maintained in their bank account. Firstly, investors have to link their bank account, either savings account or current account, to their FD account. Investors who are eligible and have a bank account in the same bank as their FD can opt for a sweep-in facility. The sweep-in facility is available only for eligible investors. Moreover, the bank will not charge any fees or penalty for withdrawing the swept-in money from the FD. Therefore, investors are not losing out on interest on FD but only the swept-in money that is withdrawn. The excess amount invested in the FD through the sweep-in facility can be withdrawn without breaking the entire FD. Alternatively, investors who have a premium account with a minimum balance ranging from INR 25,000 to INR 1,00,000 can opt for the sweep-in facility on their FDs. An investor who has invested a minimum of INR 25,000 in the FD is eligible for a sweep-in facility. Not all investors are allowed to avail of the sweep-in facility. Also, it allows investors to earn a higher return than the savings account on the surplus money. The excess amount that is invested through the sweep-in facility will earn the same interest as the FD. The rate of interest for the sweep-in FD account will be similar to any normal FD and will depend on the term of the FD. The term of a sweep-in FD ranges from one to five financial years. However, certain banks also allow transfers in the range of INR 1 – INR 1,000 as per the instructions given by the investor. Minimum investmentīanks usually transfer surplus money in the savings account to sweep-in FD in multiples of INR 1,000. Also, all banks insist that the investor should have a bank account in the same bank as the FD to avail sweep-in facility. It is important that the current or savings account is linked to the sweep-in FD account. Features of a Fixed Deposit Sweep-in Facility Linking bank account to sweep-in FD account Investors can draw funds from the FD without any fees or penalties to meet their short term requirements.

This allows investors to earn higher returns on their surplus money and also allows investors to dip into the FD in case of emergencies. Investors can state the amount that they want to hold in their savings account and current account, and the rest will be automatically transferred to the sweep-in FD account. The tenure of the sweep-in FD ranges from one to five years, depending on the bank. The sweep-in facility in a fixed deposit allows investors to transfer their excess funds in the bank account to their FD account hence giving them an opportunity to earn higher returns. This article covers sweep-in FD, its features, advantages, and how it differs from Flexi-FD in detail. Not only can they earn a higher FD rate of interest, but they can also withdraw money from the FD without breaking it to meet their short-term requirements.

What is the Difference Between Sweep-In FD and Flexi FD?Ī sweep-in FD will allow investors to invest excess funds lying idle in a bank account in a fixed deposit account to earn higher returns.What are the Advantages of Investing in Sweep-In FD?.How Can You Avail of the Sweep-In FD Facility?.Features of a Fixed Deposit Sweep-in Facility.

0 kommentar(er)

0 kommentar(er)